By Dan L. Mitchell, Consumer Finance Expert | Published April 29, 2025

In 2025, the market is flooded with discounts, promotions, and clever sales tactics designed to catch your eye. But with rising costs and sophisticated marketing, how does a consumer know whether a purchase may be a good deal? It’s a critical question, as falling for a flashy promotion can lead to overspending or buyer’s remorse. Studies show that 68% of shoppers abandon carts when products fail to meet expectations, and 41% prioritize durability over price. This guide will equip you with practical strategies to evaluate deals, compare prices, assess quality, and shop confidently.

By the end, you’ll know how to save money, avoid buyer’s regret, and shop with more confidence. Let’s dive in!

Understanding What Makes a Good Deal

A good deal isn’t just about a low price—it’s about balancing price, quality, value, and suitability for your needs. To determine how a consumer knows whether a purchase may be a good deal?, consider these key factors:

Key Considerations:

Price vs. Market Value

When considering a deal, the first question to ask is whether the price is competitive with the standard market value. A lower price might seem appealing, but it’s essential to ensure that the lower cost doesn’t come with hidden compromises in quality or additional fees. Sometimes, what seems like a bargain may have hidden drawbacks that emerge later.

Quality and Longevity

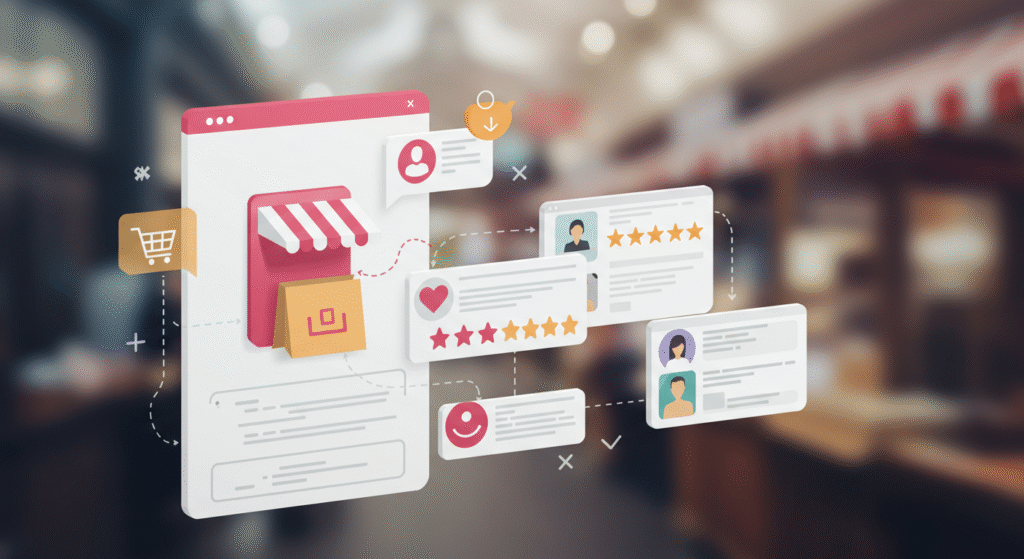

While the price is crucial, the quality and longevity of the product are equally important. A product that is built to last can save you money in the long run, even if it has a higher initial cost. Consider whether the product will hold up over time, as a low-quality item that breaks or wears out quickly could lead to greater costs down the road.

Total Cost of Ownership

A good deal goes beyond the initial price and includes the total cost of ownership. It’s important to consider any additional costs like shipping, taxes, maintenance, or recurring fees that may arise after the purchase. These added expenses can make a seemingly affordable deal much more expensive in the long run. Always evaluate the full financial picture before making your decision.

Suitability for Your Needs

A good deal should address a real need or problem in your life. It’s important to ask yourself whether the product will provide actual value or just end up as an unnecessary purchase. A great deal aligns with your specific needs, improving your life or simplifying a task.

Example:

A $300 printer might appear to be a good deal initially, but when you factor in the $50 per month cost of ink, the total expense over time can quickly surpass what you would spend on a more expensive printer with lower running costs. The initial price might seem attractive, but ongoing costs could make it far more expensive in the long run. Understanding both upfront and recurring costs helps you determine the true value of the purchase.

Compare Prices Like a Pro

Why It’s Important: Comparing prices can help you save a significant amount—usually between 10-30%. Prices can vary greatly from one retailer to another, meaning a little extra time spent shopping around can lead to substantial savings. This applies to everything from everyday items to larger purchases, such as electronics.

Tools to Help Compare Prices:

Websites:

- Google Shopping: This platform lets you compare prices from various online stores, providing all the details you need about each product.

- PriceGrabber: A handy tool for comparing prices, reading product reviews, and tracking price trends.

- ShopSavvy (2025 Update): Offers the ability to track product deals, stock availability, and discounts from both major and smaller stores.

Browser Extensions:

- Honey: This extension helps you find and apply the best coupon codes automatically during checkout, while also comparing prices across different online retailers in real-time.

- CamelCamelCamel: Specializes in tracking Amazon prices, showing price history, and notifying you when prices drop.

AI Price Trackers:

- PricePulse: This AI-powered tool alerts you about potential price drops and uses smart algorithms to predict when prices will fall, helping you make the best purchase decision.

Useful Tips:

- Compare both online and in-store prices: Local stores may offer special in-store discounts that online retailers don’t provide. It’s always worth checking both before making a final decision.

- Track price patterns: High-cost items like electronics tend to have price drops during major sales events like Black Friday or Cyber Monday. Watching for these trends can save you money.

- Be mindful of hidden fees: The lowest advertised price isn’t always the final price. Watch out for extra charges like shipping, taxes, or additional service fees that may add up.

| Tool | Type | Key Features | Pros | Cons |

|---|---|---|---|---|

| Google Shopping | Website/App |

|

|

|

| PriceGrabber | Website/App |

|

|

|

| ShopSavvy | Mobile App |

|

|

|

| Honey | Browser Extension |

|

|

|

| CamelCamelCamel | Website/Extension |

|

|

|

| PricePulse | Mobile App |

|

|

|